866-765-3151

Has covid, supply chain issues, high gas prices, interest rates & inflation cut into your profit margins?

You're not alone.

Everyday we speak to local business owners who are wrestling with how to stay profitable.

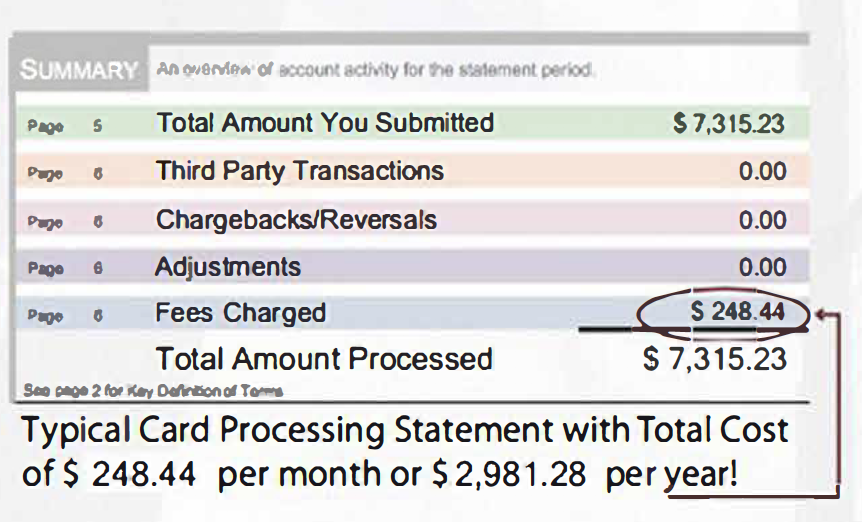

We feature a price model thats like your own revenue generating machine because you pay 0% in processing fees to accept credit cards.

Plus we give you FREE equipment and some amazing technology that's simple to use and makes running your business so much easier.

Most of our clients are keeping

$10-20k plus in their business each year and it didn't cost them a dime to start saving!

Free Equipment & No Processing Fees!

Flat rate pricing is like your very own revenue generating machine.

It's your money, we help you access it.

Your monthly credit card processing volume

Your additional annual revenue when you don't pay processing fees.

- $/Year

Kelly Schoeberl, Owner

Olive Juice Studios

We took credit cards with PayPal before working with Chris at NoblePay. Now we're paying so much less than we ever did before. In fact, a local vendor walked into our gallery, asked to see our statements (assuming he could do better) and said he couldn't give us a better rate and that he'd be wasting our time to try.

Dual pricing keeps your money where it belongs.

In your pocket.

For decades, gas stations haven't paid fees to take credit cards. They don't lose customers because they give them a choice to pay with cash & save.

Thanks to regulation changes in the payments industry your business can benefit too.

You don't need to offer a cash discount or dual pricing to pay 0% in processing fees.

Flat rate pricing is available as a stand alone product.

We love dual pricing but maybe you don't want to offer 2 prices at your store.

Maybe you don't have a store & hardly see your customers so collecting cash is rare or not an option.

Maybe you aren't interested in offering a cash discount at all.

Not a problem.

Flat rate pricing will still work for you!

A small price increase that builds the processing expense into your price will do the trick!

We have access to compliant technology that isolates the processing fee at the time of the sale so you get 100% of your money.

If you still want to offer a discount on those rare occasion's you do see your customer; simply press a button & the system will automatically extend a discount.

Jon Benson, CEO

Sellerator.com

I’ve been working with merchant accounts for over a decade, and I’ve run into almost every problem you can think of: extreme withholding periods, lack of flexibility around launches, poor customer support, and more. Working with Christopher at NoblePay has been a totally unique experience. Not only are our rates better and withholdings lower, Christopher responds to us very fast. These guys know how to work with Internet marketers to a degree I’ve yet to encounter with any other merchant service. Highly recommended!

Tim Brown, CEO

Dr. Kareem Samhouri Fitness, LLC

Chris is our main man when it comes to merchant accounts. He's always got our back and is amazing to work with. Chris handles all of our merchant accounts and looks out for our accounts as if they were his own. Chris is who we always recommend to other internet marketers. He'll definitely get you the best deal available and cut out all of the merchant processor BS for you.

In Store Payments

On The Go Payments

Ecommerce Payments

Invoicing & Recurring Payments

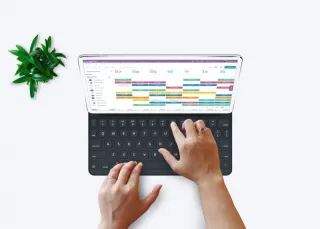

Payanywhere® is the all-in-one payments platform powering your business.

Think outside the square.

Hiring Tools

Post your openings for free on the top job boards or via optional paid postings. Sort, rate, and schedule your candidates from all sources at once.

Employee Management

-Build a team with unique roles and permissions.

-Assign employees as administrators, managers, cashiers, or reporters with customizable levels of access.

-Break down sales by employee.

-Keep tabs on your staff even while you're away.

-Generate reports on individuals or groups of employees by transactions completed, volume sold, tips, payment method, and more.

-Protect your point of sale.Avoid losses and track employee activity by customizing who can log in, complete a sale, issue a refund and update stock counts.

-Securely share your back office tools.

-Give trusted employees access to the business management and reporting features within Payments Hub.

Scheduling

Drag & drop scheduling that forecasts labor costs as you go.

Send to your team by text, app, and email.

Time Clock

Allows your employees to:

-Clock in

-Take breaks

-Declare tips, and rate their shift right from the Payanywhere app.

Inventory Management

Manage your inventory and the products you sell.

It’s simple to sell, track, and restock your items with Payanywhere’s free inventory tools.

Build a cloud-based library

Your own flexible catalog of products that’s easy to sort and accessible from any device.

You’ve never felt this organized.

Save time by uploading your inventory in bulk with Payanywhere's easy-to-use template.

Items & categories

Create items with multiple price variants.

Sort them into categories for faster access at the time of a transaction.

Modifiers

Customize your items at the time of sale with modifier sets.

Discounts

Create preset discounts based on percentage or dollar amount, or add one on the fly. Apply to an entire order or a single item.

Sell with one tap

The items in your library are immediately available on your point of sale. Just tap an item to add it to an order.

Go faster with barcode scanning

Use a Bluetooth barcode scanner or your device camera to quickly scan an item and add it to an order.

Track stock with ease

Create custom low stock alerts per price line, and get notified immediately when an item is out of stock. Your inventory syncs in real-time across all your devices no matter where sales are made.

See what's hot and what's not

Track sales by item, category, modifier, and discount.Export stock reports, item performance, and transactions by category.

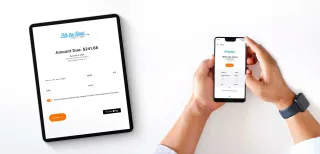

Invoices

Send invoices and never miss a payment.

Get paid with one-time or recurring invoices that your customers pay online. Email your customers invoices from your point of sale or your back office. Turn any in-person transaction into an invoice directly from the Payanywhere app, or send directly from your Payments Hub portal.

Automate recurring billing cycles

-Generate repeat invoices automatically at the frequency you set.

-Allow customers to enroll in autopay.

-Customers on a recurring invoice cycle can opt to automatically be charged using autopay.

-Add custom branding to your outgoing invoices and payment pages.

-Create a seamless customer experience by adding your logo and contact information to every touchpoint.

Recurring Billing

-Automate recurring billing cycles.

-Generate repeat invoices automatically at the frequency you set.

-Allow customers to enroll in autopay.

-Customers on a recurring invoice cycle can opt to automatically be charged using autopay.

Sales Reporting

Maximize your sales with customer-driven data.

In all likelihood, your competitors are using analytics to help them increase their efficiency and profitability. That means you should be too.

Your account provides access to the merchant reporting tools you need to get the most out of your data.

Get ready to take advantage of advanced analytics and dashboards for virtually everything!

Real time insights into your business.

Every transaction tells a story with reporting and analytics tools from Payanywhere.

Make smarter decisions based on your sales data.

See trends and compare to historic sales for volume, payment type, customers, employees, and inventory.

Keep tabs on your business any time, anywhere.

Got an internet connection?

Get a quick overview or create in-depth reports that will help you streamline your operations and keep pace with your competitors.

Access reports in-app or through our secure, online merchant portal, both of which come free with your merchant account.

Take a quick glance at your day.

Get a snapshot of your day's activity with a detailed dashboard showing real-time totals for your gross sales, total transactions, and average ticket amount.

Track your employees in a flash.

Sort your employees by volume or number of transactions.

Filter transactions by one or more employees. Or create an employee flash report for instant access to their totals for: Net sales, discounts, taxes, tips, voids & payment methods.

Manage your inventory

Keep track of your stock.

Set custom low stock alerts.

Enable out-of-stock sales. Then, sync quantities across devices.

See what's selling and what's not with item and category performance sorted by volume and quantity sold. We make inventory management easy.

Get to know your customers better

Gain invaluable insights into your customers by tracking their number of visits, total sales amounts, and more. Use your receipts to encourage customer feedback by inviting them to rate their experience with you.

Get a quick overview or drill deeper

Access your sales data or check your deposits from any device in real time. View at-a-glance sales including daily and yearly summaries from your Apple Watch. Get more details with in the payments app or the complete picture in Payments Hub online merchant portal.

Customer Management

When you're running a business, nothing is more important than your relationship with your customers.

Customer management that works for you.

-Gain detailed yet easy-to-understand insights into your customers with our customized reporting.

-Create customer profiles. Then, sort them by filters you choose, so that you can sell to your customers more effectively than ever before.

Now, you'll know:

-Who spends the most money during their visits.

-Who visits your business most often.

-Who is a first-time buyer and more.

-You can even export your customer list to use any marketing tools you choose, allowing you to more effectively advertise to your customers via email campaigns, SMS and so on.

-Solicit customer feedback & reviews.

-Want to find out more about your customers and how to better serve them? Just ask them!

-Customizable receipts allow you to ask for customer feedback via surveys that allow them to rate their experience.

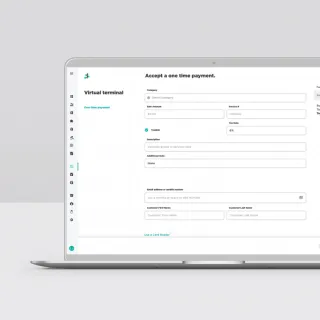

Virtual Terminal

Accept payments in your web browser.

The Virtual terminal feature within the Payments Hub portal allows you to accept credit cards right from your computer.

-Take orders online or over the phone and process payments on the spot.

-Key in credit card details and process a payment anywhere you have an internet connection.

-Your transactions will instantly appear on your activity page.

Funding options that fit your business.

With next day and same day funding, you're in control of your daily deposits.

On-site technicians

Setup custom tax rates for doing business across municipalities

Send receipts via email or text message

Home service providers

Accept tips and set custom tip presets

Save customer info and cards on file for repeat business

Transportation companies

Charge customers at time of sale with mobile card readers

Create a new sale via Quick Entry or choose frequently used services from the Item Catalog

Professional services

Send invoices via email or text

Save cards on file for easy billing of established clients

Potential to lower fees with Level III Interchange Qualification

Healthcare providers

Setup scheduled payments for future appointments

Charge customers over the phone with the Virtual Terminal

Nonprofit organizations

Save customer information and gain individual-level insights

Create recurring payments for regular donations

Accept donations on social media or on the web with Payment Links

Salons & spas

Create visual Favorites pages for quick access to popular services

Set custom preset tip amounts for easy customer gratuity

Specialty food & beverage businesses

Utilize Item Catalog for fast and easy checkout

Use custom discount rates for special promotions

Automotive providers

Save customer card on file for repeat business

Manage employee access with role-based user profiles

Payanywhere Smart Flex.

PAX E600.

Smart Flex Point of Sale.

Free equipment placement.

$29.95/mo license.

0% processing.

Learn more.

Payanywhere Smart POS.+

Smart Terminal.

Free equipment placement.

$24.95/mo license.

0% processing.

3-in-1 Bluetooth Credit Card Reader.

Free equipment placement.

$9.95 monthly.

0% processing.

DeJaVoo Z8.

Free equipment placement.

$9.95 monthly.

0% processing.

Pickle Barrel.

Carla was one of the first business owners in her area to implement cash discounting.

Watch her tell her story. The concerns she had about being the first and how well things are going since adding cash discounting.

Meet Chris, your personal payments consultant.

My name is Christopher Swift (most people call me Chris or Swifty). I grew up in Arlington MA, graduated in 1990 and have degrees from Fitchburg State University & Emerson college. I met my wife Paula while in college back in 1993 and we've been together ever since.

We got married in 2000 and have been living in Framingham, MA since 2003 with our 3 boys. I've been an active member of the community volunteering much of my time coaching hockey in the Framingham program for 11 years. I'm a past president of the BNI Commerce Connection chapter in Wayland, a current member of the Metrowest Chamber of Commerce, a member of the Networking USA chapter in Framingham and and have owned NoblePay in Sudbury since 2008.

Prior to starting NoblePay I was a partner in a publicly held company also in the payments industry. Paula owns and operates a photography studio in Sudbury MA & I'm also a partner in an auto detail company called We Care Car Care North in Framingham which has a bricks & mortar shop and fleet offering mobile services.

I think I bring a unique perspective that few can match as not only do I understand the world of payments. I also understand and share the same excitement, challenges & pressures you likely experience in operating your business.

You can learn more about how I can help you by clicking here.

What a cash discount program is NOT.

There's a bit of confusion out there as it relates to what these types of programs are called and how they work.

The card brands make it very clear that a merchant can NOT penalize a customer for paying with a credit card.

If you’re adding a fee at the register, whether you call it a “service fee” or a “non-cash adjustment fee”, it is a surcharge and is considered non-compliant.

The Durbin Amendment, included as part of the 2010 Dodd-Frank law, permits businesses to transfer all or a portion of their processing fees onto their customers.

Merchants may not charge more than 4%.

3% is the maximum allowed effective April 15, 2023 for compliant surcharge merchants. Complaint surcharge programs require registration & regulatory compliance reviews and annual costs to participate.

Thanks to the amendment, companies can now legally offer a discount to those who pay with cash or check instead of a credit or debit card.

There are no registration or regulatory requirements for cash discounting and it is legal in all 50 states when implemented correctly.

The card brands make it very clear that a merchant can NOT penalize a customer for paying with a credit card.

Business owners should understand the key differences between both programs to ensure they are on the right side of the law and avoid card brand regulatory compliance issues, which can result in fines and other penalties assessed from the card brands.

Having a personal payments consultant like Christopher Swift on your side makes all the difference. Chris will train you and your team to provide a beautifully transparent and enjoyable customer experience for your valued patrons. You can learn more about how Chris can help you by clicking here

What is a cash discount?

A “cash discount” means you offer a discount off the listed price as it appears on the shelf or a menu if somebody pays with cash.

What is a cash discount program?

A method of implementing an increase in price to all your customers, while giving a discount to those who pay with cash. When a customer pays with a card, our technology isolates the price increase and applies it to your processing fees so that you never again have to worry about an unpredictable processing bill!

What is dual pricing?

Unfortunately, until now, true dual pricing was not available to most retailers and restaurants due to both limitations of POS software to support dual pricing and the unpredictability of exact payment processing cost on each transaction.

Therefore, business owners with many different items or SKU’s could not easily know exactly how to price merchandise under a dual pricing model. More importantly, business owners were unable to offer dual pricing while providing a beautifully transparent and enjoyable customer experience to their valued patrons.

All that has changed!

There are 3 things needed for a business to run a true, honest and transparent dual pricing program.

A business owner willing to take the time and care to present a beautiful customer experience to all of their valued customers.

Your customer deserves to know how much each product will cost when they decide to purchase it.

A merchant services provider who offers a flat rate percentage that aligns with the difference between the regular and cash prices without any additional charges.

You need to know your cost on each item in order to price correctly.

A POS system capable of supporting a dual pricing model with both a regular price and a cash price for each product or SKU in a business while providing the accurate reporting needed to support the business operations.

The Business Owner’s Experience

The benefit of the dual pricing program to the business owner is you no longer have to concern yourself with the rising costs of accepting payments.

You profit the same as if all transactions were cash.

Our processing partners simply retain the difference between the regular price and cash price to pay all processing and program costs for you.

All those fees you're used to seeing with your current payments provider like PCI compliance fees, batch header, transaction and statement fees etc., are all rolled into your flat rate we pay them on our end.

No more surprises.

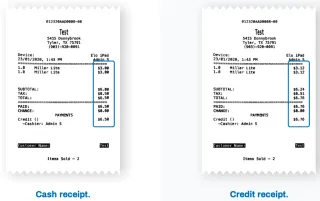

Your customers will check out as normal and your POS will keep a running total of both the regular price and the cash price.

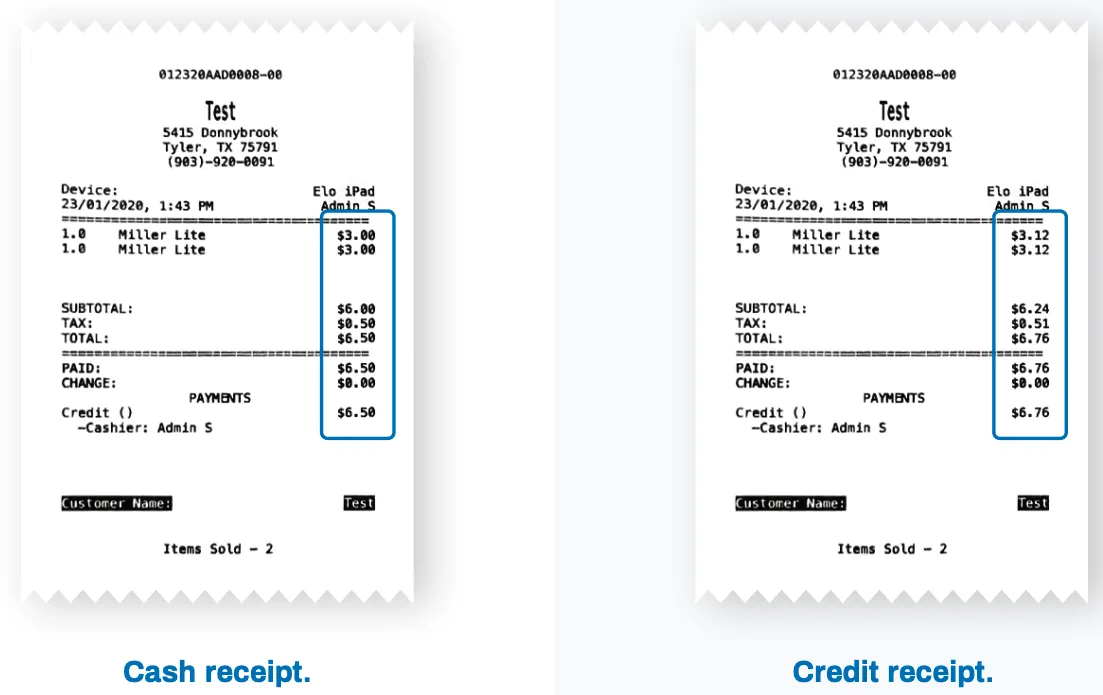

When your customer chooses their payment method, the POS will print-off the itemized receipt with the correct corresponding prices.

Flat rate pricing.

Advertising credit prices and offering a discount if paid with cash.

This is the most straight-forward method of cash discounting.

In this example the merchant simply raises all of their prices by 3-4%.

So if the price was $100 now it would be $103-$104.

If the customer pays by cash, the merchant can opt to press a button on their compliant point of sale equipment / software.

This will automatically adjust the price back to $100 allowing the discount for paying by cash.

Be careful as commonly used but considered a non-compliant program is disclosing a customer service charge at the register and waiving it if the customer pays with cash.

Having a personal payments consultant like Chris on your side makes all the difference.

Chris will train you and your team to provide a beautifully transparent and enjoyable customer experience for your valued patrons. You can learn more about how Chris can help you by clicking here

What is the difference between the flat rate & dual price cash discount program?

The words cash discount seem to have have different meanings which can be confusing.

The Durbin amendment allows a business to incentivize cash as their preferred method of payment.

As I'm sure you know, every-time you accept a credit card payment you're losing between 2-4% of your profits.

Both programs allow you to level your margins so cash and credit sales are equal.

Both programs allow merchants to not have to pay processing fees and get 100% of their money.

This is done (2) ways.

Flat Rate Pricing

Business increases their price.

If the thought of doing this makes you feel like you'll lose customers, I promise thousands of merchants had that concern before working me.

I think it’s important to remember that this is a fair price increase that will most likely go unnoticed. We’re really talking about cents on the dollar to make this problem of rising processing costs that keeps getting worse over time go away for good.

I understand the concern, losing customers means you’re risking losing money.

However this is probably the least riskiest action you can take in your business to make money.

Any other risk you take costs money and isn’t guaranteed.

We’re guaranteeing you’ll make money by implementing this program.

No one wants to increase prices, but let's be real, if a business has a 10% profit margin, inflation goes up by 7% and credit card fees are 3%, the business is going to fail if it doesn't keep up with those costs.

The 3.5% - 4% covers processing fees not only today but ALL FUTURE INTERCHANGE INCREASES... meaning, this isn't a bandaid to merchant account fees, it permanently removes them in the future as they go up TOO".

If the product was $100 now the price would be increased by 3.5% or $103.50.

Card Sale

If a card is used the the $3.50 is isolated at the time of the sale and used to cover the processing expense and all of the usual confusing items normally see on a merchant statement.

Those don't go away and they won't be seen on your processing statement as we cover all of that on the backend so you don't need to worry about it.

Cash Sale

When cash is used you can extend a discount to the customer by pressing a button on your device.

The technology automatically calculates the discount so you never need to calculate a thing!

So the discounted price would be $100

Dual Pricing

Unfortunately, until now, true dual pricing was not available to most retailers and restaurants due to both limitations of POS software to support dual pricing and the unpredictability of exact payment processing cost on each transaction.

Therefore, business owners with many different items or SKU’s could not easily know exactly how to price merchandise under a dual pricing model.

More importantly, business owners were unable to offer dual pricing while providing a beautifully transparent and enjoyable customer experience to their valued patrons.

All that has changed!

There are 3 things needed for a business to run a true, honest and transparent dual pricing program.

A business owner willing to take the time and care to present a beautiful customer experience to all of their valued customers.

Your customer deserves to know how much each product will cost when they decide to purchase it.

A merchant services provider who offers a flat rate percentage that aligns with the difference between the regular and cash prices without any additional charges.

You need to know your cost on each item in order to price correctly.

A POS system capable of supporting a dual pricing model with both a regular price and a cash price for each product or SKU in a business while providing the accurate reporting needed to support the business operations.

The Business Owner’s Experience

The benefit of the Dual Pricing program to the business owner is you no longer have to concern yourself with the rising costs of accepting payments.

You profit the same as if all transactions were cash.

Our processing partners simply retain the difference between the regular price and cash price to pay all processing and program costs for you.

All those fees you're used to seeing with your current payments provider like PCI compliance fees, batch header, transaction and statement fees etc., are all rolled into your flat rate we pay them on our end. No more surprises.

Your customers will check out as normal and your POS will keep a running total of both the regular price and the cash price.

When your customer chooses their payment method, the POS will print-off the itemized receipt with the correct corresponding prices.

Surcharge vs. Cash Discount - What's the difference?

Surcharge

A surcharge is a fee added to a credit card transaction to offset credit card processing costs. The customer pays more than the advertised price for paying with credit card.

Cash discount

A cash discount is a discount applied to the total amount when a customer pays with cash. The customer pays less than the advertised price for paying with cash.

If you’re adding a fee at the register, whether you call it a “service fee” or a “non-cash adjustment fee”, it is a surcharge.

According to Visa a merchant is permitted to offer discounts for paying in cash, however, the discount must be given as a reduction from the standard price.

Surcharge vs. Convenience Fee or Service Fee - What's the difference

Surcharge

A surcharge is a fee added to a credit card transaction to offset credit card processing costs. The customer pays more than the advertised price for paying with a credit card.

Convenience fee

A convenience fee is a fee added to a transaction for the convenience of paying with an alternative payment channel that is not standard for the business. For example, movie theaters may charge a convenience fee to pay for tickets online. The fee is not charged when paying in person at the ticket booth because this is the standard payment channel.

Service fee

A service fee is a fee added to a transaction for providing a service and is limited to certain merchant categories (education and government merchants).

Do I need specific equipment to implement this program?

Not at all!

The partners I work with can integrate with almost every technology.

They have multiple POS and terminal options if you're looking to upgrade.

Many are free for as long as you process and cost between $0 - $39 /mo.

Take a look at our hardware options - Learn more.

How do I know if this program is right for my business?

If you're tired of an unpredictable processing bill every month.

Want to virtually eliminate your processing fees.

Do not want to be locked into a long-term commitment, and need customer support that is efficient and fast; this program is perfect for your business.

This really is like a revenue generating machine that pays you every month and every year.

What would you do with an extra $10,000 every year?

Most of our clients are enjoying an average of $20,000 per year!

I have clients who use that money to take vacations, purchase automobiles, real estate, pay off debt, pay for college, fix equipment and so much more!

What will you do with your savings?

Is there a specific industry that this program works best in?

Both the flat rate & dual pricing cash discount programs are simple and flexible programs that operate well across all industries and are legal in all 50 states. Both level your margins so cash and credit sales are equal.

The good news is that most customers are very supportive of small businesses and understand how challenging the last 3 years have been.

They understand that in these hard times businesses need to make good financial decisions in order to stay profitable.

This program is working all over the country.

In the city, in the suburbs, in rural communities, in low income communities, in wealthy communities and everything in between.

These merchants all have the exact same motivation to launch this program.

To create their own revenue generating machine by taking advantage of the Durban amendment.

Now they can legally increase their prices by no more than 4% and provide a discount for cash paying customers just like gas stations have been doing for decades.

Will I lose customers?

Have you ever raised your prices before?

Did you lose customers?

We think it’s important to remember that this is a fair price increase that will most likely go unnoticed. We’re really talking about cents on the dollar to make this problem (your cost to accept credit cards) that keeps getting worse over time go away for good.

We understand the concern, losing customers means you’re risking losing money. However this is probably the least riskiest action you can take in your business to make money.

Any other risk you take costs money and isn’t guaranteed.

We’re guaranteeing you’ll make money by implementing this program.

If it doesn’t work like I know it does I can give you your bill back and get you lower rates than what you were paying. I can tell you that the only way I make my money is if you’re processing credit cards. If it didn’t do everything I know it does I’d have lot of in unhappy merchants and I’d be out of business.

No one wants to increase prices, but let's be real, if a business has a 10% profit margin, inflation goes up to 7% and credit card fees are 3%, the business is going to tank if it doesn't keep up with those cost.

The 4% covers cc fees not only today but ALL FUTURE INTERCHANGE INCREASES... meaning, this isn't a bandaid to cc fees, it permanently removes them in the future as they go up TOO".

I would argue that there’s never been a better time in modern history to raise prices. Covid, supply chain, inflation, high gas prices, high interest rates and other rising costs have significantly cut into merchants profits.

How has it effected your margins?

The good news is that most customers are very supportive of small businesses and understand how challenging the last 3 years have been.

They understand that in these hard times businesses need to make good financial decisions in order to stay profitable.

This program is working all over the country.

In the city, in the suburbs, in rural communities, in low income communities, in wealthy communities and everything in between.

These merchants all have the exact same motivation to launch this program.

To create their own revenue generating machine by taking advantage of the Durban amendment.

Now they can legally increase their prices by no more than 4% and providing a discount for cash paying customers just like gas stations have been doing for decades.

What will my processing bill look like?

Simple & transparent.

All of those fees you used to pay don't go away we cover them.

Every cash discount program we represent are month-to-month subscriptions that allows you to process unlimited credit card transactions and offset up to 100% of processing fees.

Your monthly subscription price is locked in, meaning your processing bill will never go up for as long as you process.

Even if your transaction volume goes up or our costs go up due to annual interchange increases.

You'll always pay 0% processing fees and have one flat rate and easy to understand bill.

Do I need to use Payanywhere?

Not at all!

While we believe Payanywhere is an amazing solution that is affordable and brings amazing value, we have plenty of other

solutions we can share with you.

If you decide to move forward; you'll be working with Christopher Swift. Since 1995; Chris has built a large & trusted network of processors, technology partners & equipment providers.

Chris has personally helped thousands of small business owners setup their payment systems and is able to pivot and make recommendations based on your specific needs.

Here are just a few of the partnerships we have:

Processing partners

VizyPay

Electronic Payments

North American Bancard

Paytech Trust

Maverick

Signature

Maverick

CoinSuites

Equipment & technology

Clover

Micros

Pax

Deejavoo

Retail Cloud

Redfox POS

SalesVu

AST POS

Simply 123 Booking

Growthzilla

Hotsauce POS

Poynt

NMI

USAepay

Authorize.net

I already add my own fee to cover my processing fees

If you're currently building something into your cost to offset processing expenses, you are the perfect fit to work with us.

The problem when you do it yourself is that you put your merchant account in jeopardy as you can't charge more than the rate you pay.

All businesses have a net effective rate between 2.25-4%

Profiting off your merchant account is a violation of the terms of a merchant agreement. If they found out, they could shut the account down making it very difficult to get another account.

Since you don’t have a flat rate, a system that isolates the processing cost & pulls it out at the time of the sale, you’re not compliant.

By law processors need to send a merchant’s credit card sales activity to the IRS. When you build it in yourself; in addition to not being compliant, you can’t write anything off above what you paid as the processor and IRS know what it really cost on each transaction.

By increasing your price; all you did was make your processing bill larger. And since you can’t deduct what you added to cover the fees; so now the taxable income is higher.

Obviously, you'll pass your processing expense to your accountant, but you know as well as us that you never seem to get 100% of these things deducted. Especially whatever you added to cover the fees.

By running a compliant program, you get to deduct 100% of the processing expense.

Since we need to come in at a flat rate of 3.5-4% you have a bigger deduction.

You’re not paying fees anymore so all that money that was going to the processor stays in your pocket each month.

You’ll enjoy this new revenue stream right away instead of waiting until tax time to get a deduction.

You'll enjoy a much lower and predictable bill each month.

You always get 100% of your money just like cash.

Do you offer other merchant account programs besides cash discount?

Yes, of course!

Just understand that you will pay fees with traditional processing.

Since 1995 Chris has been helping all types of businesses accept credit cards. I have a unique ability to help mid to high risk merchants establish credit card processing services through my access to some of most exclusive processing relationships in the world. We understand how important conversion ratios are with your funnels and will show you how to follow FTC regulations and still grow sales. We show you how to reduce chargebacks and build a payment system that will be stable for the life of your business. Learn more.

This site is not part of, or endorsed by, Facebook or any social medial platform in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement.

NoblePay is a gateway powered by NMI.

Copyright 2023 All Rights Reserved. Privacy.